From office provides to authorized charges, these expenses encompass a big selection of miscellaneous costs which may be essential for the day-to-day operations of a company. A company’s “sundry income” is a source of money that is not substantial and is usually insignificant in comparison with the revenue it generates via its operations. Whereas miscellaneous earnings won’t make up a significant portion of a company’s whole revenue, this does not imply that the portions are insignificant. As a result, companies need to know the relevant tax implications when accounting for varied kinds of earnings. If companies observe proper accounting and management procedures, sundry earnings becomes a priceless source of further revenue for enterprises.

- Also, these expenses don’t match into different standardized basic ledger accounts such as Wages, Salaries, Advertisement, and so forth. to call a quantity of.

- Reconciliation ensures that the general ledger displays the true financial status.

- These items don’t match neatly into the first classes of a company’s accounts, actually because they are rare or comparatively minor transactions.

- Creating particular person invoices for many small sundry objects could be inefficient, however grouping them too broadly can cut back financial transparency.

- Automated instruments can send approval requests to relevant stakeholders as quickly as a sundry invoice is generated.

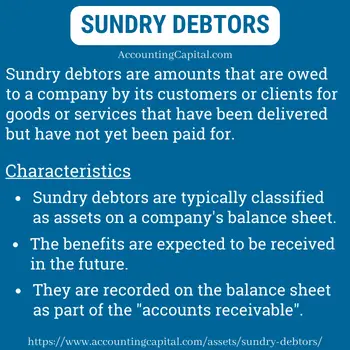

Sundry debtors symbolize the revenue owed to a business by its clients for goods or providers supplied on credit score. Efficient administration of sundry debtors immediately impacts a company’s money move, reduces the danger of dangerous debts, and enhances buyer relationships. While sundry revenue contains all of the miscellaneous sources of earnings a enterprise could generate, sundry bills embody the irregular, small expenses that are not otherwise assigned inside the account.

Key Elements Of A Sundry Bill

These challenges can affect the accuracy of economic records and complicate accounting processes if not handled properly. There are a number of misconceptions about sundry invoices that can result in confusion or improper accounting. Addressing these misconceptions helps improve understanding and administration of sundry transactions. On the stability sheet, sundry debtors and sundry creditors are recorded as current assets and current liabilities, respectively.

What’s A Sundry Invoice?

They create a single line for miscellaneous prices to avoid cluttering the revenue statement with zero lines of surprising and uncommon bills. Since sundry prices impression your monetary outcomes, it’s unimaginable to not account for them if complete sundry bills increase yearly. Effective administration of sundry debtors plays a pivotal position in sustaining the monetary health of a enterprise. By guaranteeing immediate cost from clients, optimising cash move, minimising unhealthy debts, and fostering optimistic buyer relationships, companies can leverage sundry debtors to drive development and profitability. Efficient administration of sundry debtors permits businesses to optimise their cash flow by making certain prompt payment from prospects. By tracking and monitoring outstanding payments, businesses can take proactive measures to gather dues, decreasing the risk of money move disruptions and enhancing total monetary liquidity.

Establishing clear insurance policies for when and the method to issue sundry invoices improves record-keeping and reduces errors. Since sundry invoices cover diverse gadgets, clear descriptions and documentation are essential sundry accounting to avoid confusion with clients or suppliers. Whether you are a small business or a large corporation, sundry costs and income are inevitable elements of your accounting. They assist in forming precise monetary statements and foster knowledgeable administration choices.

Efficient value administration of workplace provides is essential for companies of all sizes, because it instantly impacts the general finances and monetary well being. The strategic procurement and utilization of these items can contribute to enhanced productiveness and organizational effectivity. Workplace provides, as an example, are crucial for day-to-day activities, from pens and papers to computer equipment.

Sundry Credit Score Notes: Reversing Transactions

The artist could be categorized as a sundry creditor as a result of it’s a small, irregular transaction, not part of the café’s traditional provide chain. By grouping these transactions collectively, companies save time and maintain their monetary reports cleaner and easier to manage. Sundry invoices may be incidental, but the complexity behind their appropriate dealing with is way from trivial.

Avoid using them in instances of fixed asset gross sales, which must be dealt with by way of proper asset disposal documentation. Equally, if you’re charging for inventory objects or project-based providers, those ought to go through commonplace gross sales invoices. Even with fundamental tools like Microsoft Excel or Google Sheets, sundry invoices can be created and tracked manually. It’s clever to hold up a logbook the place every sundry invoice is listed with particulars like date, recipient, amount, and standing. In the creative business, freelancers incessantly use sundry invoices to cost late charges or to bill for added companies that weren’t part of the initial contract.

Maintaining communication between these departments improves collections and payments related to sundry invoices. Reviewing these reports offers insights into the influence of sundry transactions on general profitability and money circulate. Begin by establishing a transparent sundry invoice policy that defines what kinds of transactions are considered sundry and the thresholds for amounts. This readability helps accounting staff correctly identify and report sundry invoices.

The platform works exceptionally properly for small businesses which are simply getting began and have to determine https://www.kelleysbookkeeping.com/ many issues. As a results of this software program, they can stay on prime of their client’s necessities by monitoring a timely supply. A division is established for various debtors Sundry invoices and these along with the supplementary documents are submitted to the administrator’s office.