FIFO accounting, or first-in, first-out, is a method of valuing stock. It’s principally an assumption for cost-flow purposes that states the primary items you purchased are the first items you offered. This assumption most closely https://www.kelleysbookkeeping.com/ resembles an actual circulate of merchandise incomes it the distinction as essentially the most correct valuing methodology in theory. Think About your native grocery store — the first gallons of milk the shop purchased to promote to clients are the first gallons bought often. In Any Other Case, plenty of milk (product) would spoil, thus making a loss for the store.

35 – Good: Does What The Product Should Do, And Does So Better Than Many Competitors

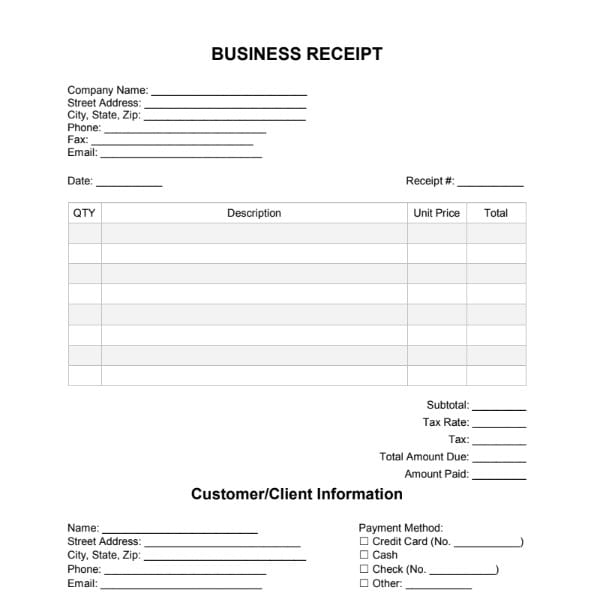

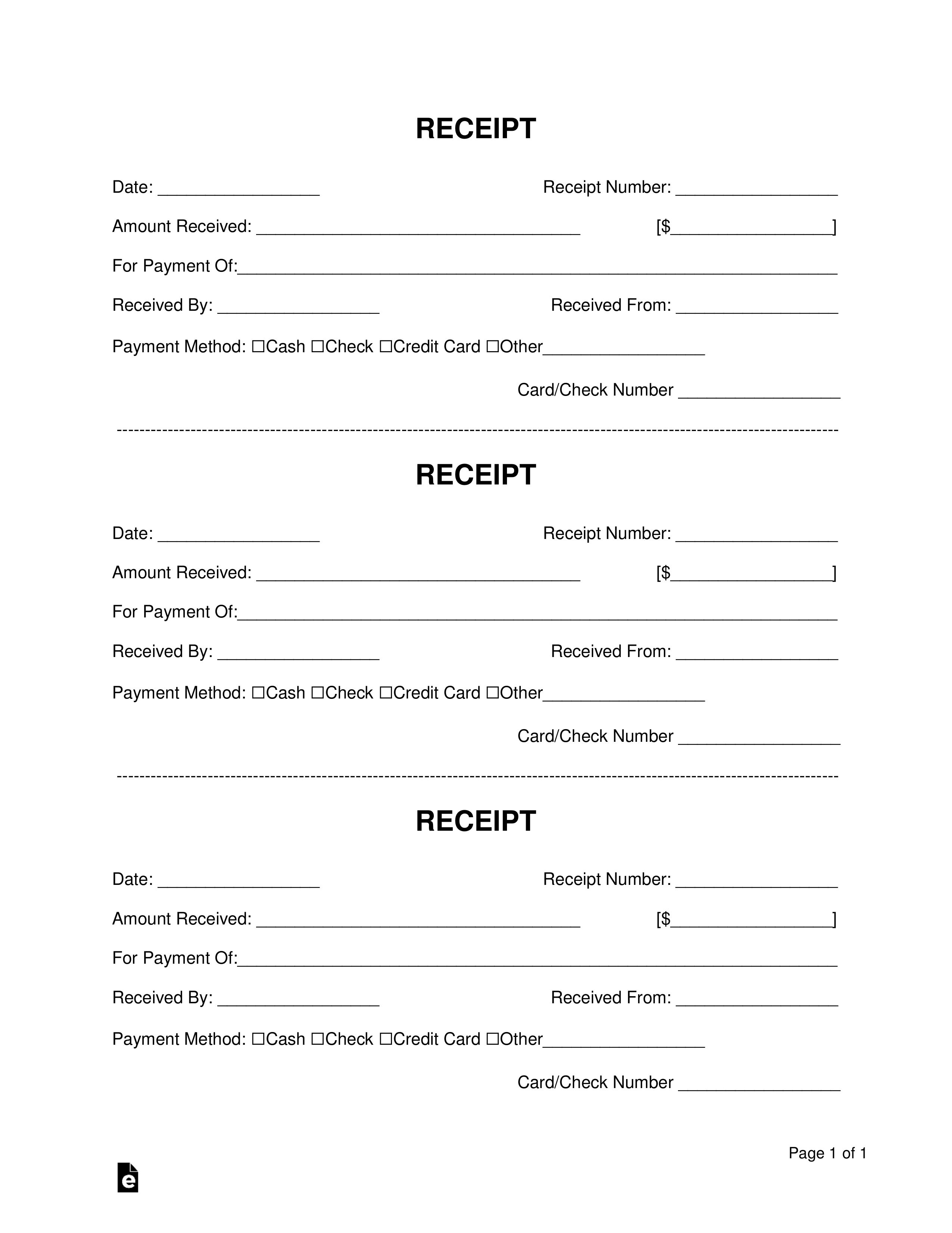

Retailer business & private documentation proper where you need it. Connect pictures, receipts, and warranties to their underlying transactions — and discover them with just some clicks. Not Like Coursera and different opponents, Udemy allows you to purchase individual courses, including free and deeply discounted courses. As Soon As you obtain a course, you normally have lifetime entry to the fabric.

The pie chart offers a approach to drill down and see the transactions in a selected category. You can also see which transactions are uncategorized, so you’ll find a way to easily assign them to categories. This part reveals you the way much cash you may have coming in and going out, so you probably can pay payments on time and keep away from late payments and overdraft charges. Quicken displays it solely when needed, such as when writing checks from a money account or logging handbook bills. Quicken mechanically assigns categories to downloaded transactions utilizing merchant codes. To use Quicken you must start by including your financial accounts.

If you manufacture goods, your inventory accounting entries will reflect a quantity of levels of completion. If you produce picket furniture, some of your inventory may be unfinished wood products, furniture at present quicken bookkeeping on the assembly line, and finished items. In your ledger, the finished items stock will reflect the variety of each sort you have at any time. Recording just the value of these supplies with the money technique would possibly offer you an inaccurate image of how a lot you’re — or must be — spending on supplies. In single-entry bookkeeping, each transaction is recorded as a single entry in a ledger, while in double-entry bookkeeping, a transaction is recorded twice.

Quicken Classic Vs Simplifi: Which One Is Right For Managing Your Money?

If you’re looking for a cheap budgeting tool, Quicken is well value your time. On high of this, it offers some pretty rudimentary accounting features, which might be value wanting into if you’re a property proprietor or a microbusiness owner. Next is the QuickBooks Plus plan, which costs $99 per month and supports five customers. QuickBooks Online is a full-fledged small-business accounting software product with superior financial reporting and lots of of app integrations. Quicken is constructed for managing personal or household finances however has a couple of enterprise tools obtainable.

As Soon As the bill payment rolls in, QuickBooks’ automatic matching perform will then discover and pair the payments to its bill, letting users know which invoices are carried out and that are outstanding. Automated alerts can also let customers know when their invoices have been seen by a consumer, even if they haven’t paid. As with the QuickBooks plans outlined above, the Payroll plans are presently available at half worth for the primary three months of a year-long contract.

Whether you employ Quicken or QuickBooks On-line relies upon largely on what sort of finances you should handle. For lower than $4 per thirty days, you should use Quicken’s lowest-priced plan to handle your personal finances. Whereas there isn’t a free trial, there’s a 30-day money-back assure. So, when you don’t prefer it, you’re not locked in for the entire 12 months you already paid for. QuickBooks accounting software program may help you ease into the accrual methodology of accounting by making certain that your data are accurate, primarily based on information from your bank card or fee apps.

- The software program program can then make the calculations for you, providing you with an accurate image of your complete income and spending that’s updated each time your money strikes.

- The software can be utilized to track revenue and expenses, create invoices and receipts, and generate monetary reviews.

- With this function, a recurring invoice could be set for a daily, weekly, month-to-month, bi-monthly, or yearly withdrawal.

- Paid programs supply graded quizzes, projects, and a course certificates upon completion.

Intuit, the corporate that created QuickBooks, provides bookkeeper certifications via Coursera. You can enroll for the Intuit Academy Bookkeeping Professional Certificate to get sixty five hours’ worth of coaching and a credential to show on your work. If you’re more of a hands-on learner, QuickBooks Online could be the way to go. With this guided answer, customers can save time with specialists who can help them streamline workflows and care for tedious bookkeeping duties.

Can I Use Quicken Products On My Computer Or Mobile Device?

This method, when you make a buy order, you’ll have the ability to immediately file the receipt within the relevant expense class, saving you time when you need to make your expense calculations. As you steadiness Accounts Receivable in opposition to Accounts Payable, the result’s your web earnings. Divide this quantity by internet sales amount to obtain your revenue margin. If the ratio of income to debt is small, you’re working with a narrow revenue margin.

Whereas superior parameters aren’t but user-facing, Guru suggested extra choices could be added via Zoho’s Zia Agent Studio sooner or later. If there are any uncategorized transactions, a message seems with a hyperlink that can take you to a listing of the uncategorized transactions. Quicken lets you create a total of 11 views to trace completely different monetary areas. The Uncategorized card is a wonderful useful resource that you can use to assign categories to your transactions. You can click on any transaction to review it on an inventory of your uncategorized transactions. The Current Transactions card exhibits you what transactions you’ve made in the last three days.