The world’s quickest and most secure OCR Seize and Knowledge Extraction app for receipts, payments and invoices are here. Veryfi retrieves distributors, payments, totals, taxes, and even line items in seconds. Neat Receipts is an clever organization device and transportable scanner. You can scan receipts, contact cards, and paperwork on the go utilizing the Neat Receipts cell scanner, as the software detects, retrieves and organizes pertinent data what receipts to keep for personal taxes. It enables your workers to submit their receipts shortly in digital format. The optical character recognition algorithms within the app remove human errors that may happen when instantly inputting information from receipts.

Keeping Good Data

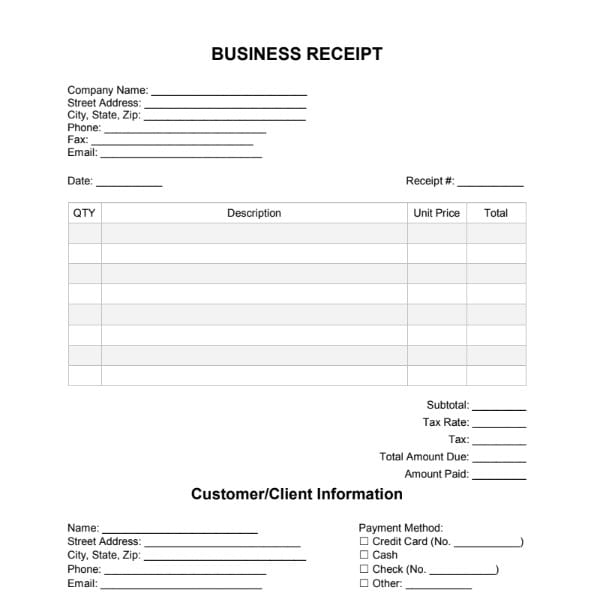

It this category you’ll have the entire invoices, deposit data, paperwork from receipt books, POS reports, and so on. It’s important to know that for normal bills paid by credit card, you no longer need to avoid wasting the receipt. So, any sort of paperwork that show your income for that 12 months ought to be stored.

If you retain medical receipts, tax deductions will be simple to make and can minimize your monetary burden should you’ve spent a lot on medical therapies. Hopefully, you might have an HSA to help decrease your medical bills liability. Business house owners aren’t the only ones who must be preserving receipts. Many taxpayers qualify for tax deductions that would require proof within the type of a receipt. Typically canceled checks are not enough to assist a deduction, based on Lee.

This submit is only for informational functions and is not https://www.kelleysbookkeeping.com/ meant to be legal, enterprise, or tax advice. Regarding the issues discussed on this submit, every particular person ought to seek the guidance of his or her own lawyer, business advisor, or tax advisor. Vincere accepts no duty for actions taken in reliance on the knowledge contained in this document. By “extra proof,” we imply a report of what you have been doing and who else was involved.

Robert Kiyosaki: 5 Finest Ways To Spend Your Tax Refund Subsequent Year

“What we inform customers is that we’ll accept receipts or another documents any way you can get them to us,” said Jake Brereton, advertising manager of Shoeboxed.com. “You can ship bodily paperwork, you’ll be able to take photos of documents and put them into the uploader, you’ll have the ability to ship documents along with your scanner and e-mail them—really anything.” For bills not in the classes we’ve listed, you might be succesful of get a duplicate of the receipt by contacting the company or provider. An example can be medical expenses, where you would call your doctor and ask them to send you a replica of the receipt. Of course, receipts must also be organized by category and by date.

- That can be an e-mail about your upcoming enterprise journey, or a calendar occasion for lunch with a shopper.

- All of this data can then be sent on to your accountant or accounting app.

- In some cases, the CRA may accept a duplicate of your bank statements which prove that the funds left your account and have been issued to the institution.

- Once you have saved all your paperwork and receipts for the yr, you could be set to file your taxes.

- Keeping bank statements is especially important if you’re self-employed or work a self-employed gig on the aspect.

- You can contact us anytime in case you have questions or encounter an issue together with your bookkeeping program.

Maintain The Important Papers

If you are an individual submitting a federal revenue tax return, you’ll find a way to go for the standard deduction. We suggest choosing the standard deduction if it is the same as or higher than your itemized deductions. In this case, it wouldn’t be essential to hold your receipts as a end result of the bills wouldn’t be claimed. Many tax consultants will let you know that you must maintain receipts for tax functions for three years from the date you filed or two years from the date you paid your taxes, whichever is later.

In addition, keep information of any inherited property and its worth when the owner died, which is in a position to turn out to be your tax foundation. You should have lived within the home for no less than two of the past 5 years to qualify for the exclusion. Even so, you’ll want to save your real property closing assertion for no less than three years after selling the property. To deduct dangerous debt, you have to show that you’ve taken reasonable steps to attempt to gather the funds, in accordance with the IRS. Money loaned to pals or family that you don’t count on to be paid back is taken into account a gift, not bad debt. For one, the IRS has six years to audit your return should you underreported your earnings by 25 p.c of the gross income proven on your return.