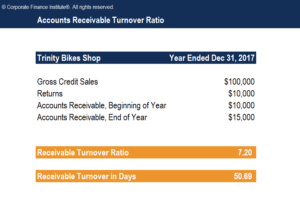

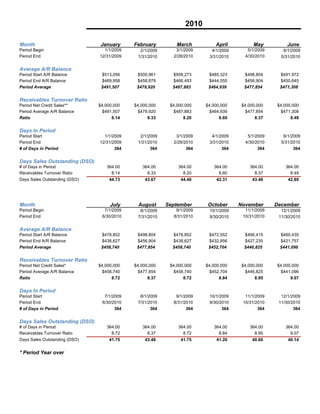

With 90-day phrases, you probably can anticipate building companies to have lower ratio numbers. If you’re in development, you’ll want to research your industry’s common receivables turnover ratio and compare your company’s ratio based mostly on those averages. To determine your common collection interval, divide the variety of days in your accounting cycle by the receivables turnover ratio.

This suggests efficient credit insurance policies and efficient management of receivables, which might improve cash circulate and liquidity. Conversely, a decrease ratio implies slower assortment instances, doubtlessly impacting cash circulate and liquidity negatively. The ratio quantifies how properly an organization manages the credit score it extends to prospects on invoices and how long it takes to collect the outstanding debt.

Finance groups can use AR turnover ratio when making steadiness sheet forecasts, as it provides a general expectation of when receivables will be paid. This permits corporations to forecast how much money they’ll have on hand so they can higher plan their spending. Additionally often recognized as the debtor’s turnover ratio, AR turnover measures how effectively an organization collects cash owed from their prospects or shoppers and manages its line of credit course of. To calculate accounts receivable turnover in days, divide 365 by your accounts receivable turnover ratio. This calculation offers you a clearer picture of your average assortment interval (in days), which is beneficial for benchmarking.

Business norms, capital depth, seasonal gross sales patterns, and dealing capital administration all matter. Accounts receivable turnover, accounts payable phrases, and inventory strategy affect short-term asset and legal responsibility balances. Capital intensity, money cycle size, and buyer fee terms differ across industries. Practical levers—improving accounts receivable and negotiating provider terms—help convert assets into money. A calculated 1.7 instance reveals strong coverage, yet targets should match each company mannequin and time cycle for sound investment and capital selections.

As you can see above, what determines a “good” accounts receivable turnover ratio depends on various factors. Holding the reins too tightly can have a unfavorable impression on business, whereas being too lackadaisical about collections results in limited money circulate. To calculate the accounts receivable turnover ratio, you must calculate the nominator (net credit sales) and denominator (average accounts receivable).

Finance & Accounting Related Companies

It tells you that your collections team is effectively following up with prospects about overdue funds. A high ratio also indicates that the corporate has a generally sturdy buyer base, as prospects are likely to pay their invoices on time. When doing monetary modelling, businesses will also use receivables turnover in days to forecast their accounts receivable steadiness. They’ll do this by multiplying their income for each period by their AR turnover days, then dividing the product by the variety of days in the interval. SaaS billing software saves time and vitality, improves money circulate, and enhances buyer relationships. An ideal resolution can handle the complete billing course of — from issuing invoices and sending reminders to offering a number of cost options and monitoring payments.

Present Ratio Vs Fast Ratio (acid-test): When Each Metric Issues

Let’s break down the elements of the Accounts Receivable Turnover Ratio method and calculation for simple understanding. As per IMARC Group’s report, the worldwide accounts receivable automation market reached USD 2.8 billion in 2024 and is projected to hit USD 6.4 billion by 2033 rising at 9.7% CAGR. One of the best ways to convey context to your knowledge is to look at your outcomes towards benchmarks. In AR turnover’s case, there are very few https://www.personal-accounting.org/ definitive benchmarks publicly out there.

- And even if your company’s ratio is within business norms, there’s at all times room for enchancment.

- The larger the turnover, the quicker the enterprise is collecting its receivables.

- It is often used to assess your company’s collection tendencies and calculate key ratios, corresponding to Accounts Receivable Turnover.

- This is essential for assembly short-term obligations and making strategic investments.

If the accounts receivable turnover is low, then the company’s assortment processes doubtless want adjustments to be able to fix delayed fee points. Accounts Receivables Turnover ratio is also called debtors turnover ratio. This indicates the number of occasions average debtors have been converted into cash during a yr. This can also be known as the efficiency ratio that measures the company’s ability to collect income. It additionally helps interpret the efficiency in utilizing a company’s belongings in probably the most optimum method.

Invensis is a specialized finance and accounting company providing complete accounts receivable services. Our expertise in collections, streamlined processes, and superior technology optimizes AR turnover. With a devoted focus on environment friendly management, we guarantee lowered DSO, improved liquidity, and enhanced financial efficiency for companies. Contact us at present to optimize your accounts receivable and improve your business’s cash flow. Your turnover ratio helps consider if your credit policies are serving your business properly.

Low A/R turnover stems from inefficient assortment strategies, such as lenient credit policies and the absence of strict reviews of the creditworthiness of shoppers. The ARTR provides insights into an organization’s effectivity in accumulating outstanding invoices. If your company is simply too conservative with its credit administration, you might lose customers to competitors or experience a quick drop in gross sales during a sluggish economic period. On the other hand, a low ratio might indicate that your organization has poor administration, gives credit score too easily, has a riskier buyer base or spends too much on operating expenses.

Of course, you’ll need to understand that “high” and “low” are determined by industry norms. For example, giving shoppers ninety days to pay an bill accounts receivable turnover ratio formula isn’t abnormal in development but may be thought of high in different industries. In industries like retail the place fee is often required up front or on a very brief assortment cycle, corporations will typically have high turnover ratios.